Many countries have ambitious plans to increase the amount of energy produced from biomass sources. The European Union’s target to derive 20 percent of its energy from renewable sources by 2020 could require an additional 40 million dry metric tons annually for the generation of electricity. Add on to this another 60 million tons per year for heating and cooling. In the United States, legislation has been passed requiring a quarter of all national energy to be supplied from renewable sources, including biomass, by 2025. Japan is expected to incorporate more biomass into its energy mix in coming years, particularly after its recent troubles with nuclear energy at the Fukushima plant. Then there is South Korea, which has approved a new Renewable Portfolio Standard targeting 10 percent of its electricity from renewables such as biomass by 2022. The measure could raise South Korea’s consumption of biomass pellets to five million tons by the end of the decade.

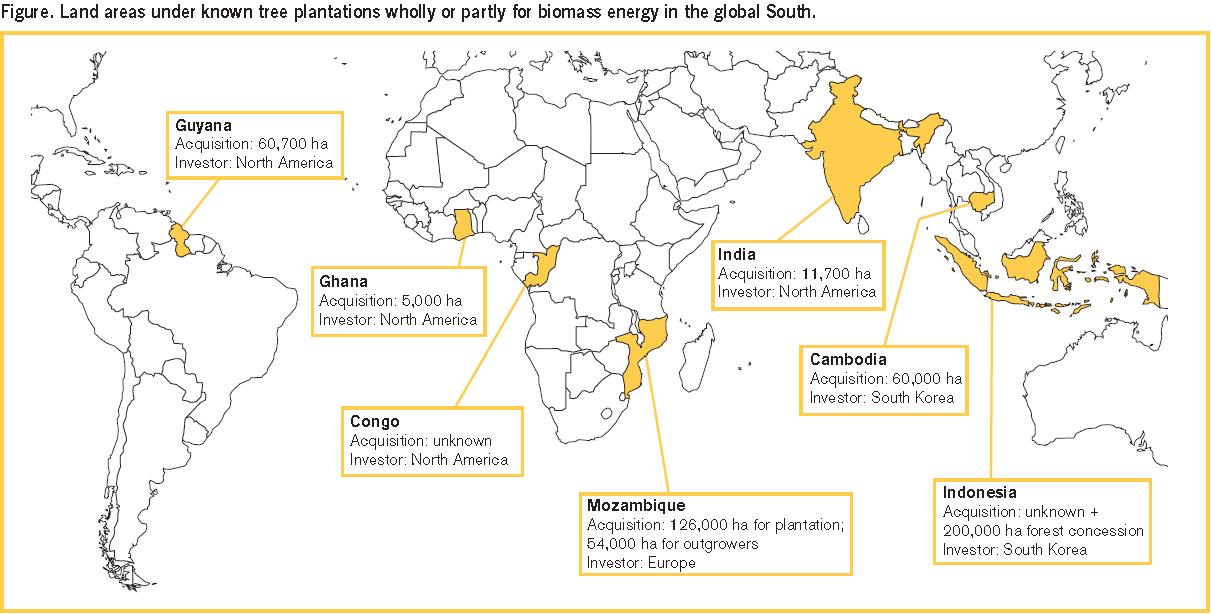

To achieve these goals many countries will become heavily reliant on overseas supplies. Traditional exporters such as Russia, Canada and the United States are stepping up production to meet this demand. Yet another trend is also visible, as highlighted by a recent IIED report: rising investment by OECD countries in developing world biomass plantations.

A timeline of known OECD-developing world biomass investments:

- An expanding presence from 1996 to present, Green Resources (Norway) in Tanzania, Uganda and Mozambique: the company began with a license to plant in the Bukaleba Central Forest Reserve in Uganda and by obtaining land at Mapanda and Uchindele in Tanzania. The company now has no less than 11 plantations in Africa encompassing 21,300 hectares. Its forests are 35 percent eucalyptus, 57 percent pine, and 8 percent teak and other species, primarily utilized for wood products and carbon offsets. A pellet mill may be eventually established at the Idete forest in Tanzania.

- August 2006, MagIndustries (Canada) in the Republic of Congo: ownership obtained of a 68,000 hectare eucalyptus plantation called Eucalyptus Fibre Congo SA. The site overlaps with the Canadian company’s magnesium and potash mineral rights near Pointe-Noire. A woodchip plant was subsequently commissioned with the first delivery completed in August 2008 to Europe.

- May 2008, Kenertec (South Korea) in Cambodia: agreement signed with the Council for the Development of Cambodia (CDC) to plant rubber trees, cassava and jatropha on 60,000 hectares. The harvested biomass is to support local power generation and for export.

- March 2009, Korea Forest Service (South Korea) in Indonesia: memorandum of understanding signed involving 200,000 hectares of forest land allocated to produce wood pellets, along with a 99-year lease on separate land. Private companies are expected to establish a pellet plant on-site.

- September 2009, Clenergen (United States) in Guyana: land leased to cultivate Paulownia trees destined for export to Europe and the US to generate electricity. The project is expected to yield at least six million tons a year by 2016.

- September 2009, Clenergen (United States) in India: two parcels of land leased in the Tirunelveli District of Tamilnadu. Here bamboo is cultivated to supply local power plants. However, it was recently reported that Clenergen would divest its Indian subsidiary.

- November 2010, Clenergen (United States) in Ghana: 48 square kilometers of de-forested land leased to grow energy crops. 100,000 tons of wood chips per year are expected by 2014.

- September 2011, Africa Renewables (United Kingdom) in Ghana: agreement made to harvest redundant rubber trees from Ghana Rubber States to be processed into woodchips and sold to the European market. The company will also establish a storage depot in the African country large enough to hold 110,000 cubic meters of biomass.

The IIED report states its concern that these plantations, along with a wave of similar investments that may come in the future, will supplant what might otherwise be used as farmland in areas of food insecurity. Hopefully increased awareness of such issues will lead to a balance in the international tradeoff between food and clean energy. But one thing is clear: sustainable supplies from developing world will be key in the global push for biomass energy.