Last month the United Nations Conference on Trade and Development (UNCTAD) released the “Technology and Innovation Report 2011: Powering Development with Renewable Energy Technologies.” The study details the amazing strides made by renewable energy in recent years, even despite the global economic downturn, and states its potential in the developing world.

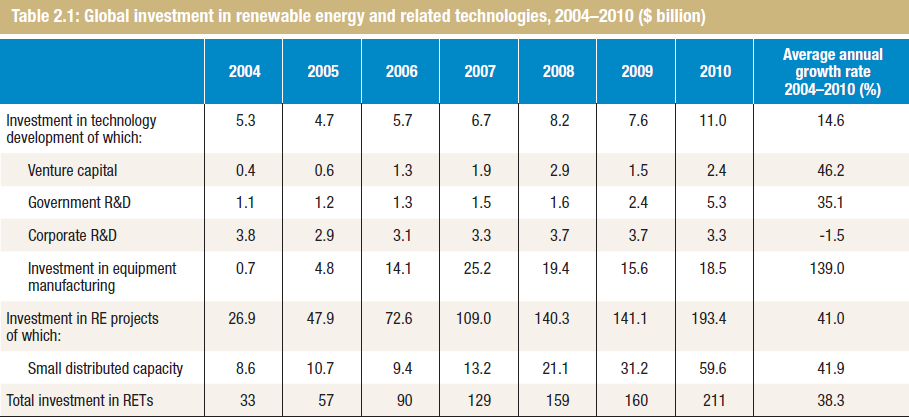

Overall investment in the industry increased nearly seven-fold from 2004 to 2010 when it reached USD 211 billion. Projects to install new power generation capacity received a greater share of these funds than did technological development.

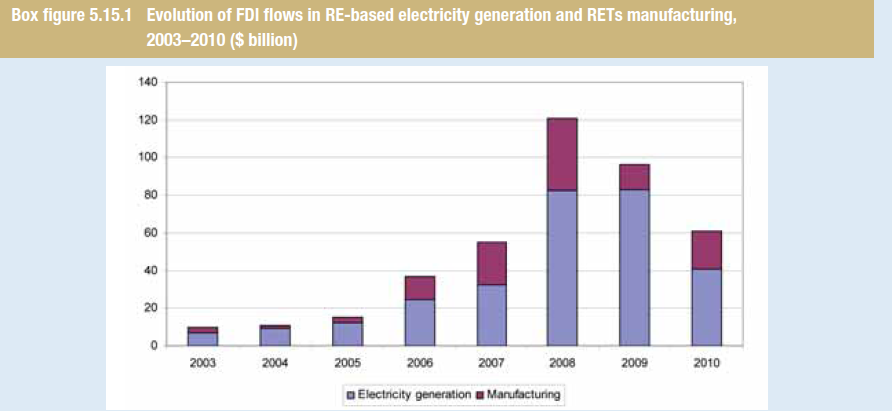

In addition to domestic initiatives, foreign direct investment has also played a crucial role in the furtherance of renewable energy. Although the impact of foreign investment on the industry has waned since the onset of the global financial crisis, international funding toward renewable energy manufacturing projects rebounded in 2010.

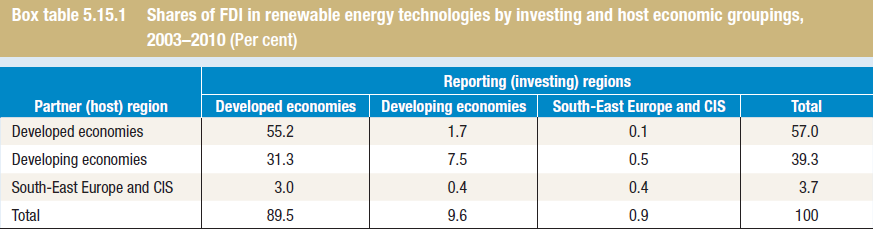

Overall, since 2003 developed countries have been both the primary source and destination of foreign direct investment. This changed in 2007. From 2007 to 2010 developing economies attracted greater international funds than their developed counterparts, with China accounting for a bulk of this investment.

Overall, since 2003 developed countries have been both the primary source and destination of foreign direct investment. This changed in 2007. From 2007 to 2010 developing economies attracted greater international funds than their developed counterparts, with China accounting for a bulk of this investment.

The development of renewable energy is particularly promising in the developing world according to UNCTAD.

…expertise in developing countries has been concentrated to a large extent in less technology-intensive RETs such as biofuels, solar thermal and geothermal. Many of these countries either have existing expertise, or stand good chances of developing such expertise and of becoming competitive exporters of such technologies. Furthermore, in the case of China and India, the sizeable domestic markets have been springboards for export success, driven, as in the member countries of the Organization for Economic Co-operation and Development (OECD), by ambitious domestic targets for renewable energy generation.

The challenge for the developing world regarding biomass is making the transition from “traditional” sources, such as tree branches and animal dung, to “modern” sources which are more efficient and pose fewer health hazards.

Ultimately, the future of biomass and other renewable energy sources is dependent on private sector investment. Development banks have been heavily involved in the financing of renewable energy projects, providing USD 13.5 billion in 2010. Public policy has also spawned more renewable energy projects, particularly since 2008 as it has been viewed as a way to engender economic growth. Yet according to UNCTAD:

…much more private investment will be needed to accelerate the development and deployment of RETs worldwide. It has been estimated, for instance, that at least $500 billion will need to be invested in new, low-carbon technologies each year starting in 2020 in order to stabilize climate change. This applies particularly to many developing countries and LDCs where investments in RETs have been much lower than in some of the larger developing countries. From a different perspective, large investments are also needed in order to scale up RETs production and reduce unit costs via the “experience curve” – which reflects economies of scale and “learning by doing”. This is very important to enable wider deployment in several smaller developing countries and LDCs that may not be able to provide direct financial support for RETs.

See the entire UNCTAD report for more information.