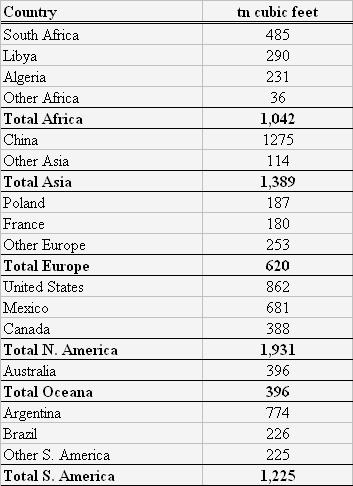

Shale gas has the potential to revolutionize the world energy market. The United States has lead the way in the extraction of this fossil fuel with the increased utilization of a controversial technique called hydraulic fracturing, or fracking. As a result, in the last decade the country’s production of shale gas has jumped twelve-fold to 4.9 trillion cubic feet. Previously an importer of liquefied natural gas, the United States may soon become an exporter. Due to the viability of exploiting shale gas, the nation’s conventional and unconventional natural gas reserves have risen to 2,552 trillion cubic feet—equivalent to Kuwait and Iran’s combined proven oil reserves.

Many other countries too have significant deposits of shale gas and hope to incorporate the resource into its energy mix. China, with the world’s largest recoverable shale gas resources, expects to eventually derive 30 percent of its energy from the fossil fuel. Several companies are drilling in Poland, which hopes to lessen its dependence on Russian natural gas imports. The same reasoning is behind the Ukraine’s approval of exploration licenses to Exxon Mobil and Shell. Last year, India struck an agreement with the U.S. government for a joint clean energy resource center to develop its shale oil gas, and in January of this year discovered its first reserve.But not all countries have been as quick to follow the United States in the commercialization of shale gas. Both geological and legal impediments have hindered the fuel’s exploitation elsewhere, particularly in Western Europe. France has issued a moratorium on fracking due to the environmental concerns associated with the practice despite the country’s abundant resources. And in South Africa, Sasol—a local petrochemical company—recently called off exploration activities in its homeland in response to pressure from environmental groups.

Technically Recoverable Shale Gas Resources

But what are the implications for the international biomass energy industry?

One major factor in the ability of shale gas to act as a substitute for biomass sources is infrastructure. The U.S.’s Energy Information Administration (EIA) has identified two tiers of countries based on their ability to utilize shale gas. In the first are countries with large resources as well as significant natural gas production infrastructure. This tier includes: the United States, Canada, Mexico, China, Australia, Argentina and Brazil. In the second tier are countries which possess abundant shale gas resources but have less developed gas-processing infrastructure. Included here are: France, Poland, Turkey, Ukraine, South Africa and Chile. It is within these first tier countries that shale gas will present the greatest challenge to biomass.

Or will it? In Canada, a consultancy recently expressed concern for the economic viability of a cogeneration project in Ontario, in part because of the potential of shale gas. However, in the same report, it notes that biogas can be transported using the same pipeline infrastructure as natural gas, thus reducing the otherwise high transport costs typically incurred with biomass sources, particularly agro-biomass. Despite the shale gas boom in the United States, the country has increased its utilization of biomass for cogeneration, particularly along the coasts. And Europe’s demand for biomass energy shows no signs of abating, as the European Union’s has determined that 20 percent of its energy will be derived from renewable sources by 2020.

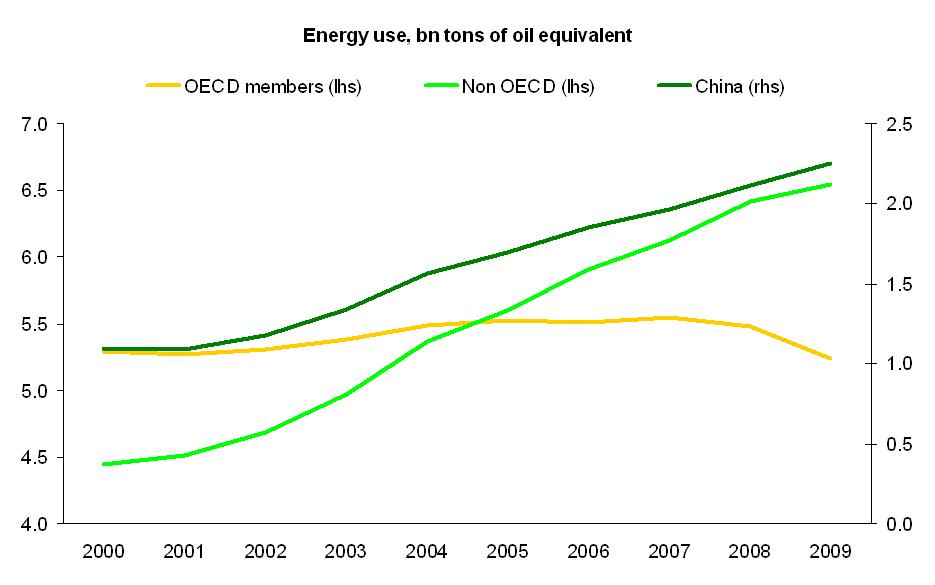

In developing countries, sheer energy demand may necessitate an expanded energy mix. Non-OECD countries increased their energy consumption by 50 percent from 2000 to 2009, whereas demand in the developed world remained relatively flat. Fast-growing China doubled its energy consumption in this time period, nearly 80 percent of which is derived from coal. Realizing the unsustainability of this, the Chinese government has promoted the development of renewable energy resources as part of its most recent five-year plan. As a result, the nation’s biomass industry is flourishing. China is not alone, as other developing countries have enacted similar incentives favoring biomass as part of their commitment to renewable energy.

Despite the potential of shale gas, its introduction comes at a time of increasing commitment to renewables along with accelerating demand from the developing world. The recent development of shale gas does not appear to threaten the biomass energy industry and in fact may be complementary, serving as evidence of a more significant ongoing trend: a shift worldwide toward cleaner energy.